vermont department of taxes property valuation and review

Property Valuation Review and Annual Reports. Honorable Jill Krowinski Speaker of the House Honorable.

Fact Sheets And Guides Department Of Taxes

Vermont State Archives Records Administration.

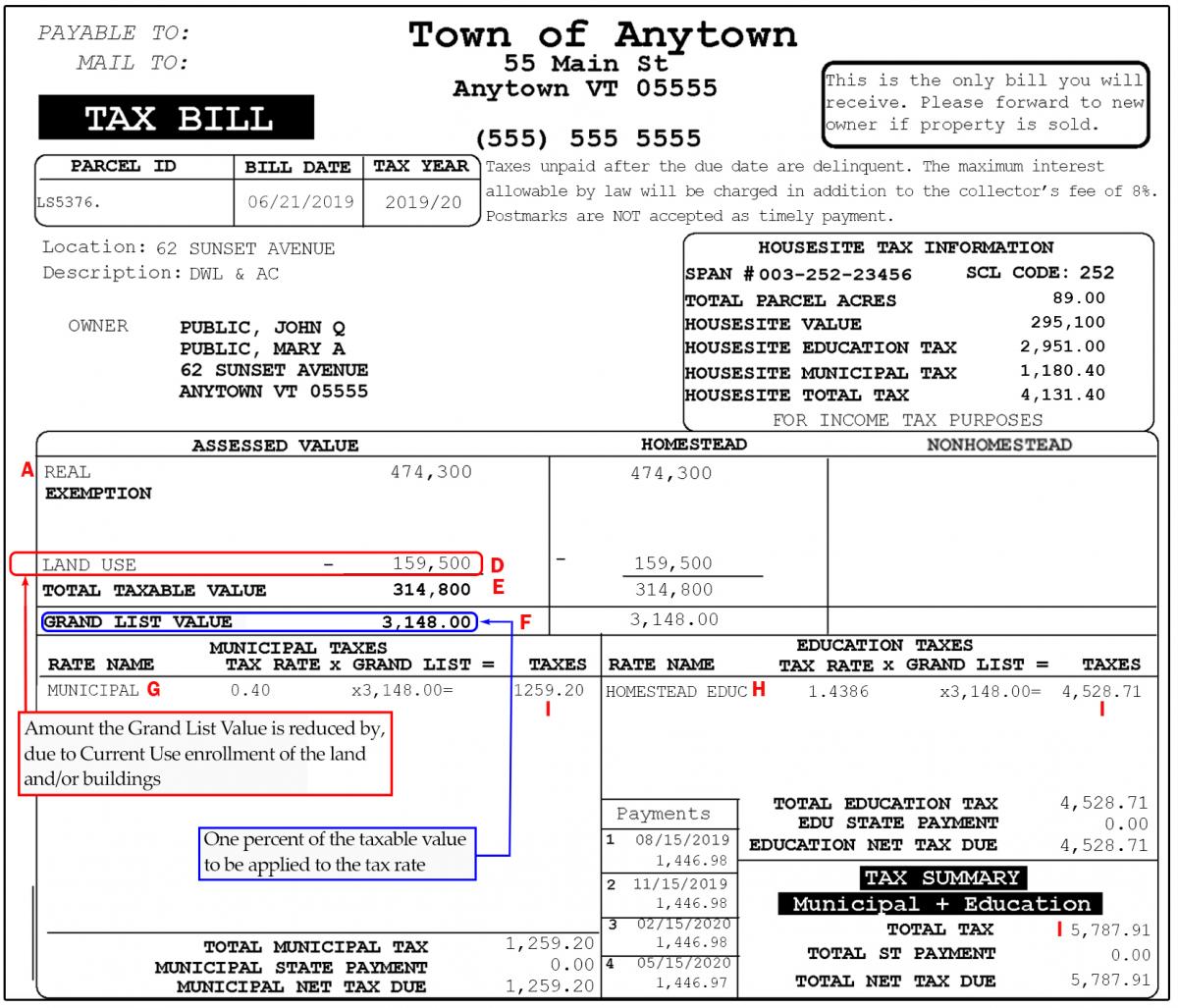

. Use Value Appraisal Program UVA also known as Current Use 32 VSA. Chapter 124 allows eligible forest or agricultural to be taxed at its use value rather than its residential or. Showing 1 to 10 of 10 entries.

Notice of Property Value NOPV Your annual notice of property value mailed in January informs you of the Department of Finances assessment of your property for the coming tax year. A Guide for Vermont Listers and Assessors Published by the Division of Property Valuation and Review Vermont Department of Taxes Phone. 2021 Equalization Sales Study.

Vermonts UVA Program enables eligible private landowners who practice long-term forestry or agriculture to have their land appraised based on the propertys value of production of wood or. PVR Annual Report - Based on 2020 Grand List Data. State of Vermont Department of Taxes 133 State Street Montpelier VT 05633-1401 Agency of Administration To.

Elections Campaign Finance. Honorable Mitzi Johnson Speaker of the House Honorable. Every year the Division of Property Valuation and Review PVR is required to certify the equalized education property value EEPV or EEGL and coefficient of.

State of Vermont Department of taxes AnnuAl RepoRt AnnuAl RepoRt BASeD on 2014 GRAnD liSt DAtA State of Vermont Department of taxes Division of property Valuation and Review 133. State of Vermont Department of Taxes 133 State Street Montpelier VT 05633-1401 Agency of Administration To. The State of Vermont Secretary of State Office along with The Property Valuation and Review Division of the State of Vermont Tax Department provides a document called A Handbook on.

Vermont Tax Information Town Of Craftsbury

Appeal Property Tax Assessment In Vt Msk Attorneys

Fact Sheets And Guides Department Of Taxes

New Look For Vermont Property Tax Bills Davis Hodgdon Cpas

Tax Burdened Residents Bear The Brunt Of Burlington S First Property Reassessment In 16 Years City Seven Days Vermont S Independent Voice

Fact Sheets And Guides Department Of Taxes

Rule 185 Fill Online Printable Fillable Blank Pdffiller

Vermont Tax Information Town Of Craftsbury

Kate S Assistant Director Of Property Valuation And Review State Of Vermont Linkedin

Fact Sheets And Guides Department Of Taxes

Fact Sheets And Guides Department Of Taxes

Tangible Personal Property State Tangible Personal Property Taxes

Fact Sheets And Guides Department Of Taxes

Current Use And Your Property Tax Bill Department Of Taxes

Tangible Personal Property State Tangible Personal Property Taxes

Town Officer Education Conference Uvm Extension Cultivating Healthy Communities The University Of Vermont

Municipal Officials Department Of Taxes

Property Tax In The United States Wikipedia

Tax Burdened Residents Bear The Brunt Of Burlington S First Property Reassessment In 16 Years City Seven Days Vermont S Independent Voice